India Mobile Gaming Market Overview 2025-2033

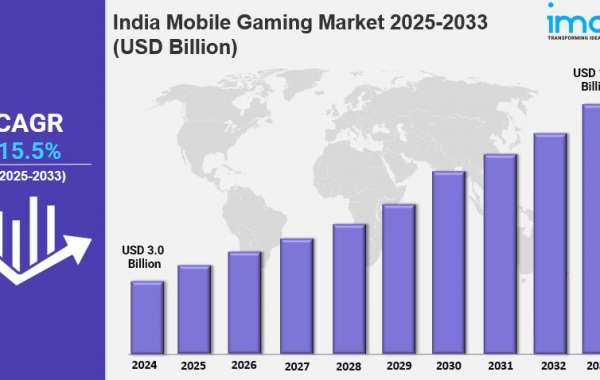

The India mobile gaming market size reached USD 3.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 11.0 Billion by 2033, exhibiting a growth rate (CAGR) of 15.5% during 2025-2033. The India mobile gaming market is expanding rapidly, fueled by affordable smartphones, widespread internet penetration, and a growing young population. Key trends include the rise of esports, casual gaming, and localized content, with major players investing in advanced technology and engaging monetization strategies.

Key Market Highlights:

✔️ Rapid expansion driven by affordable smartphones and internet access

✔️ Growing popularity of esports and casual gaming across demographics

✔️ Increasing investment in advanced technology and localized content

Request for a sample copy of the report: https://www.imarcgroup.com/india-mobile-gaming-market/requestsample

India Mobile Gaming Market Trends and Driver:

India’s mobile gaming market is witnessing unprecedented growth, particularly in esports and competitive gaming, drawing in both casual and professional players. With the increasing availability of high-speed internet and affordable smartphones, online multiplayer gaming has become more accessible than ever. Major gaming companies are investing heavily in tournaments, leagues, and streaming platforms to engage players and expand their audience, fueling the industry's rapid evolution.

Esports has moved beyond its niche status to become a mainstream entertainment phenomenon. Sponsorships, in-game purchases, and advertising are driving revenue growth, and by 2025, competitive gaming is expected to play a pivotal role in the mobile gaming ecosystem. Government initiatives supporting the gaming sector, along with the rise of mobile-first titles and localized content, are accelerating this transformation and fostering a thriving market.

Monetization strategies in mobile gaming are evolving rapidly in India. While free-to-play games continue to dominate, developers are increasingly exploring in-game purchases and advertisements as primary revenue streams. The industry is also shifting toward subscription-based and freemium models, offering players exclusive content and premium battle passes. As disposable income rises by 2025, a larger segment of players is likely to opt for ad-free experiences and paid features, reshaping how mobile games generate revenue.

The adoption of blockchain-based economies and play-to-earn models is further revolutionizing India’s gaming landscape, allowing players to earn rewards through gameplay. This innovation is enhancing player retention while attracting investors eager to capitalize on the country’s expanding digital economy. Additionally, strategic partnerships between gaming platforms and fintech companies are streamlining in-game transactions, strengthening the industry’s financial infrastructure.

India’s diverse gaming audience has led to a growing demand for mobile games with localized themes, regional languages, and culturally relevant storytelling. Developers are integrating Indian mythology, folklore, and social themes into their games to better resonate with domestic players. By 2025, there is expected to be a surge in vernacular-language games, making mobile gaming more inclusive for non-English-speaking users. Collaborations with Bollywood, cricket stars, and regional influencers are further boosting engagement, helping games gain traction across diverse demographics.

The rise of hyper-casual and social gaming, which promotes interaction in culturally familiar settings, is also driving demand. This trend is expected to shape the future of India’s gaming industry, positioning the country as a crucial market for unique, customized gaming experiences.

India Mobile Gaming Market Segmentation:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest india mobile gaming market share. It includes forecasts for the period 2024-2032 and historical data from 2018-2023 for the following segments.

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Monetization Type:

In-app Purchases

Paid Apps

Advertising

Breakup by Platform:

Android

iOS

Others

Breakup by Game Type:

Sports

Strategy

Action

Adventure

Breakup by Region:

North India

West and Central India

South India

East India

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145