Key Market Insights

- Presently, around 50 companies claim to offer DNA encoded libraries and affiliated services for drug discovery across different regions of the world; majority of the players are based in the US

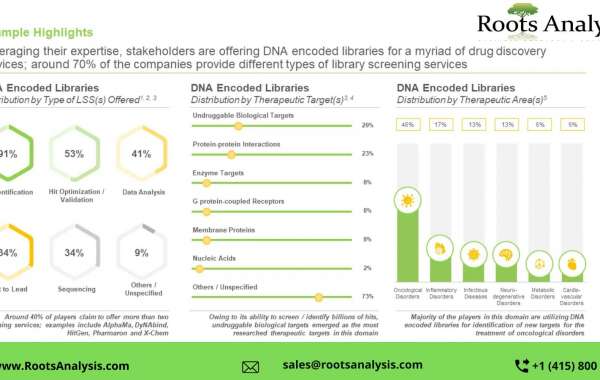

- Leveraging their expertise, stakeholders are offering DNA encoded libraries for a myriad of drug discovery services; around 70% of the companies provides different type of library screening services

- Majority of the companies engaged in this field of research are based in the developed geographies; the market landscape is fragmented, featuring the presence of both small firms and established players

- Stakeholders have adopted various business models to maximize the gain from DNA encoded libraries; a significant number of in-house players have started out-licensing their DNA encoded library platforms

- In pursuit of building a competitive edge, stakeholders are actively upgrading their existing capabilities to enhance their respective service offerings and comply with the evolving industry benchmarks

- The growing interest in this domain is evident from the rise in partnership activity; in fact, the maximum number of collaborations related to DNA encoded libraries were inked in 2021

- Several investors, having realized the opportunity within this domain, have invested over USD 4 billion across various funding rounds in the past six years

- More than 400 patents have been filed / granted by various stakeholders in order to protect the intellectual property generated within this field since 2005

- Big pharma players have undertaken several initiatives, ranging from proprietary library development to strategic investments, to tap the lucrative opportunity in this rapidly growing market

- With an objective to provide support to DNA encoded libraries focused companies / organization, several stakeholders are deploying diverse support services as well as ancillary tools

- In the short term, the opportunity is likely to be driven by library platform licensing activity; this activity is likely to increase as the industry realizes the capability of DNA encoded libraries to discover high-value therapeutic leads

- The market is expected to grow at an annualized rate of 16% between 2023-2035; the projected opportunity is anticipated to be well distributed across various market segments

Table of Contents

- PREFACE

1.1. DNA Encoded Library Market Overview

1.2. Key Market Insights

1.3. Scope of the Report

1.4. Research Methodology

1.5. Frequently Asked Questions

1.6. Chapter Outlines

- EXECUTIVE SUMMARY

- INTRODUCTION

3.1. Chapter Overview

3.2. Overview of Drug Development

3.3. Drug Discovery Process

3.4. Overview of DNA Encoded Libraries

3.5. Future Perspectives and Opportunity Areas

- MARKET LANDSCAPE

4.1. Chapter Overview

4.2. DNA Encoded Library: Overall Market Landscape of Service Providers / Platform Providers / In-House Companies

- BUSINESS MODEL ANALYSIS

5.1. Chapter Overview

5.2. DNA Encoded Library Companies: Business Model Analysis

5.3. Concluding Remarks

- COMPANY COMPETITIVENESS ANALYSIS

6.1. Chapter Overview

6.2. Assumptions and Key Parameters

6.3. Methodology

6.4. Company Competitiveness Analysis: DNA Encoded Library Service Providers / Platform Providers / In-House Companies

- COMPANY PROFILES

7.1. Chapter Overview

7.2. AlphaMa

7.2.1. Company Overview

7.2.2. DNA Encoded Library Platform and Service Portfolio

7.2.3. Recent Developments and Future Outlook

7.3. DICE Therapeutics

7.4. DyNAbind

7.5. HitGen

7.6. NovAliX

7.7. Vipergen

7.8. WuXi AppTec

7.9. X-Chem

- PARTNERSHIPS AND COLLABORATIONS

8.1. Chapter Overview

8.2. Partnership Models

8.3. DNA Encoded Libraries: Partnerships and Collaborations

- FUNDING AND INVESTMENT ANALYSIS

9.1. Chapter Overview

9.2. Types of Funding

9.3. DNA Encoded Libraries: Funding and Investment Analysis

- PATENT ANALYSIS

10.1. Chapter Overview

10.2. Scope and Methodology

10.3. DNA Encoded Libraries: Patent Analysis

10.4. DNA Encoded Libraries: Patent Benchmarking Analysis

10.5. DNA Encoded Libraries: Patent Valuation Analysis

10.6. Leading Patents by Number of Citations

- BIG PHARMA INITIATIVES

11.1. Chapter Overview

11.2. Scope and Methodology

11.3. DNA Encoded Libraries Related Initiatives of Big Pharma Players

11.4. Benchmark Analysis of Big Pharma Players

11.5. Concluding Remarks

- CASE STUDY: COMPANIES / ORGANIZATIONS SUPPORTING THE DEVELOPMENT OF DNA ENCODED LIBRARIES

12.1. Chapter Overview

12.2. DNA Encoded Libraries: Overall Market Landscape of Supporting Companies /

Organizations

- MARKET FORECAST AND OPPORTUNITY ANALYSIS

13.1. Chapter Overview

13.2. Forecast Methodology and Key Assumptions

13.3. Global DNA Encoded Library Market (Platforms and Services): Historical, Base and

Forecasted Scenario, 2017-2035

- CONCLUDING REMARKS

- EXECUTIVE INSIGHTS

15.1. Chapter Overview

15.2. Vipergen

15.3. Serengen

15.4. Deluge Biotechnologies

15.5. NovAliX

15.6. Orbit Discovery

15.7. Anonymous

- APPENDIX 1: TABULATED DATA

- APPENDIX 2: LIST OF COMPANIES AND ORGANIZATIONS

To view more details on this report, click on the link:

https://www.rootsanalysis.com/reports/view_document/dna-encoded-libraries/288.html

Learn from experts: do you know about these emerging industry trends?

At-home Self-testing: A Giant Leap Towards Transformation in Diagnostic Sector

SARM1: A Potential Therapeutic Target For Neurodegenerative Diseases

Learn from our recently published whitepaper: -

Next Generation Biomanufacturing – The Upcoming Era of Digital Transformation

About Roots Analysis

Roots Analysis is a global leader in the pharma / biotech market research. Having worked with over 750 clients worldwide, including Fortune 500 companies, start-ups, academia, venture capitalists and strategic investors for more than a decade, we offer a highly analytical / data-driven perspective to a network of over 450,000 senior industry stakeholders looking for credible market insights.

Contact:

Ben Johnson

+1 (415) 800 3415