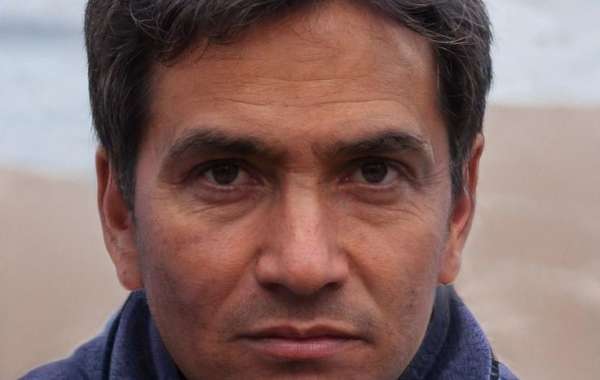

Have you ever wished you could predict the future? While we can’t tell you if it will rain next week or if your favorite soccer team will win, we can help you predict something very important – your money! This is called financial forecasting, and it’s like having a crystal ball for your finances. Let’s dive into this fascinating topic with the help of Aden Wong, who knows all about financial forecasting in Malaysia.

What is Financial Forecasting?

Financial forecasting is like looking into the future of your money. Imagine you have a magic map that tells you how much money you’ll have in the future based on what you’re doing today. It helps people and businesses plan how to spend, save, and invest their money wisely. Aden Wong, a financial forecasting expert in Malaysia, explains that it’s like setting goals and figuring out the best path to reach them.

Why is Financial Forecasting Important?

In Malaysia, financial forecasting is super important for both families and businesses. Let’s look at why:

- Planning Ahead: Just like you plan what to do on the weekends, financial forecasting helps you plan for big things like buying a house, going to college, or starting a business. It helps you save money and avoid surprises.

- Making Smart Decisions: With a financial forecast, you can decide if you can afford a new gadget or a vacation. Businesses use it to decide if they can hire more people or open a new store.

- Avoiding Problems: Imagine if you didn’t know you were running out of money until it was too late. Financial forecasting helps you see problems before they happen so you can fix them.

How Does Financial Forecasting Work?

Aden Wong explains that financial forecasting uses numbers and data to make predictions. Here’s a simple way to understand it:

- Collect Data: First, you gather information about your income (money you earn) and expenses (money you spend). For a family, this might be your parents’ salaries and the bills you pay each month. For a business, it’s their sales and costs.

- Look at Trends: Next, you look at patterns. For example, if your parents always get a bonus at the end of the year, you can expect extra money then. Businesses look at when they sell the most products.

- Make Predictions: Using the data and trends, you can guess what will happen in the future. If your family spends a lot during festivals, you can plan to save more before those times. Businesses do the same for busy seasons.

Real-Life Example: Aden Wong’s Toy Store

Let’s say Aden Wong owns a toy store in Malaysia. He wants to know if he can afford to open a second store next year. Here’s how he uses financial forecasting:

- Gather Data: Aden looks at his sales for the past year. He sees that he sells more toys during school holidays and festivals.

- Look at Trends: He notices that his sales increase by 20% every school holiday and 30% during festivals like Hari Raya.

- Make Predictions: Based on these trends, Aden predicts that next year, his sales will go up by the same percentages during holidays and festivals. He also looks at his expenses, like rent and salaries, to see if he’ll have enough money left to open a new store.

By doing this, Aden can see if opening a second store is a good idea or if he should wait until he has more money saved.

Statistics in Financial Forecasting

Statistics play a big role in financial forecasting. Here are some fun facts and figures:

- GDP Growth: Malaysia’s economy (measured by GDP) is expected to grow by about 4-5% per year. This helps businesses like Aden Wong’s toy store predict better sales as more people have money to spend.

- Inflation Rate: The inflation rate in Malaysia is about 2-3% per year. This means prices of goods go up a bit each year. Aden Wong needs to consider this when planning his costs.

- Population Growth: Malaysia’s population is growing, especially in cities. More people mean more potential customers for businesses.

Tools for Financial Forecasting

Aden Wong uses some cool tools to make financial forecasting easier:

- Spreadsheets: Programs like Excel help him organize his data and make calculations. It’s like a super-smart notebook that does the math for you.

- Software: There are special programs designed for financial forecasting that can handle lots of data and make detailed predictions. These tools help businesses make accurate forecasts quickly.

- Reports and News: Keeping up with financial news and reports helps Aden understand what’s happening in the economy and how it might affect his business.

Financial Forecasting for Families

It’s not just businesses that can use financial forecasting. Families can too! Here’s how you can help your family use financial forecasting:

- Monthly Budget: Help your parents list out all the money coming in and going out each month. This is the first step in making a financial forecast.

- Set Goals: Talk about future plans like vacations or buying something big. Figure out how much money you need to save each month to reach those goals.

- Track Spending: Keep track of where the money is going. This will help you see patterns and adjust your forecast if needed.

Conclusion

Financial forecasting is like having a superpower for managing money. Whether you’re planning for a fun vacation or running a business like Aden Wong in Malaysia, it helps you make smart decisions and avoid problems. By using simple tools and paying attention to trends, anyone can learn to predict their financial future and achieve their goals.

So, the next time you think about the future, remember that with financial forecasting, you have the power to shape it. And who knows? Maybe one day you’ll become an expert like Aden Wong, helping others in Malaysia plan their financial futures too!