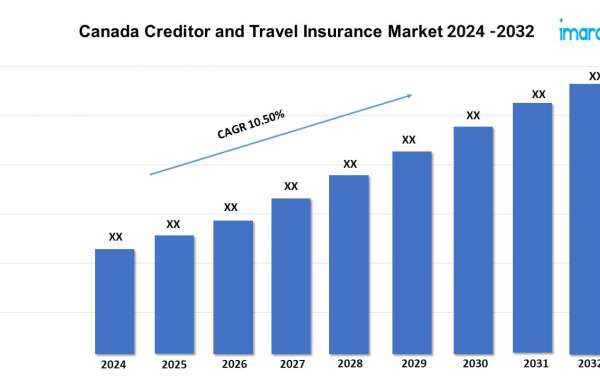

Canada Creditor and Travel Insurance Market 2024-2032

The latest report by IMARC Group, titled “Canada Creditor and Travel Insurance Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2024-2032“, offers a comprehensive analysis of the industry, which comprises insights on the Canada creditor and travel insurance market report. The market is projected to exhibit a growth rate (CAGR) of 10.50% during 2024-2032.

Creditor insurance, also known as credit insurance or payment protection insurance, is designed to cover a borrower’s debt repayments in case of unexpected events such as death, disability, or job loss. This type of insurance ensures that the outstanding loan or credit card balance is paid off or the monthly payments are made if the borrower cannot meet their financial obligations. It provides peace of mind to both the borrower and the lender, reducing financial risk and ensuring continuity in repayment. Travel insurance is a type of insurance coverage designed to protect travelers from unexpected events and expenses during their trips. It typically includes coverage for trip cancellations, medical emergencies, lost or delayed baggage, and other travel-related issues. Travel insurance can also cover emergency evacuations and aid services. It is particularly valuable for international travel, where healthcare costs and travel disruptions can be significantly higher, offering financial protection and support in unforeseen situations.

For an in-depth analysis, you can refer sample copy of the report: https://www.imarcgroup.com/canada-creditor-travel-insurance-market/requestsample

The growing concerns about health and safety while traveling, especially internationally, are driving the need for robust travel insurance policies that offer extensive medical coverage and emergency assistance. Some countries require proof of travel insurance for entry, prompting travelers to purchase policies to meet these requirements. The availability of online platforms and digital tools has made purchasing travel insurance more convenient, increasing its adoption among tech-savvy consumers. Insurers are offering more tailored and flexible travel insurance plans that cater to diverse traveler needs, from adventure sports coverage to business travel insurance. Economic fluctuations and job market instability increase the demand for creditor insurance as consumers seek protection against potential financial hardship due to unemployment or disability. With increasing levels of household debt in Canada, more borrowers are opting for creditor insurance to safeguard their financial commitments in case of unforeseen circumstances. Greater awareness and understanding of the benefits of creditor insurance are driving more consumers to consider it as a necessary financial safety net. Financial institutions often promote creditor insurance as part of their loan and credit card offerings, making it more accessible and integrated into the borrowing process. With the rise in both domestic and international travel, more Canadians are seeking travel insurance to protect themselves against potential disruptions, medical emergencies, and other travel-related risks.

Canada Creditor and Travel Insurance Market Report Segmentation:

The report provides an analysis of the key trends in each segment of the market, along with forecasts at the country levels for 2024-2032. The market has categorized based on type.

Type Insights:

- Creditor Insurance

- Product Type

- Life Insurance

- Disability Insurance

- Job Loss Insurance

- Critical Illness Insurance

- Customer Type

- Individual Borrowers

- Personal Loans

- Mortgages

- Credit Card Balances

- Small and Medium Enterprises

- Business Loans

- Lines of Credit

- Distribution Channels

- Banks and Financial Institutions

- Insurance Companies

- Credit Unions

- Mortgage Brokers and Financial Advisors

- Online Platforms

- Travel Insurance

- Product Type

- Trip Cancellation/Interruption Insurance

- Emergency Medical Insurance

- Baggage Insurance

- Accidental Death and Dismemberment Insurance

- Comprehensive Travel Insurance

- Customer Type

- Leisure Travelers

- Business Travelers

- Students

- Senior Citizens

- Adventure Travelers

- Distribution Channels

- Insurance Companies

- Travel Agencies

- Banks and Credit Card Companies

- Online Platforms

- Product Type

- Individual Borrowers

- Product Type

Competitor Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant. Additionally, the report features detailed profiles of all major companies in the cement industry.

Other key areas covered in the report:

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Market Dynamics

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

- Top Winning Strategies

- Recent Industry News

- Key Technological Trends & Development

Note: If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARCs information products include major market, scientific, economic, and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

Our offerings include comprehensive market intelligence in the form of research reports, production cost reports, feasibility studies, and consulting services. Our team, which includes experienced researchers and analysts from various industries, is dedicated to providing high-quality data and insights to our clientele, ranging from small and medium businesses to Fortune 1000 corporations.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145