A mortgage calculator is an invaluable software that helps prospective homeowners establish their regular mortgage payments centered on different factors. By inputting facts including the loan amount, curiosity rate, loan expression, and sometimes home fees or insurance premiums, the calculator may rapidly calculate what a borrower can expect to pay for each month. This instrument is especially useful for first-time homebuyers who may not need an obvious knowledge of how mortgage funds are structured or what they are able to afford. By using a mortgage calculator, people may get a sharper photograph of their financial obligations and better program their budget accordingly.

The primary purpose of a mortgage calculator would be to estimate the regular payment. Including not merely the principal and fascination but also can incorporate additional fees like house taxes, homeowners insurance, and also personal mortgage insurance (PMI) if the borrower puts down significantly less than 20% of the home's value. These additional costs can significantly influence the sum total monthly payment, therefore it's important to component them in when assessing affordability. Some advanced mortgage calculators actually let customers to take into account homeowners association (HOA) charges, that may differ depending on the neighborhood.

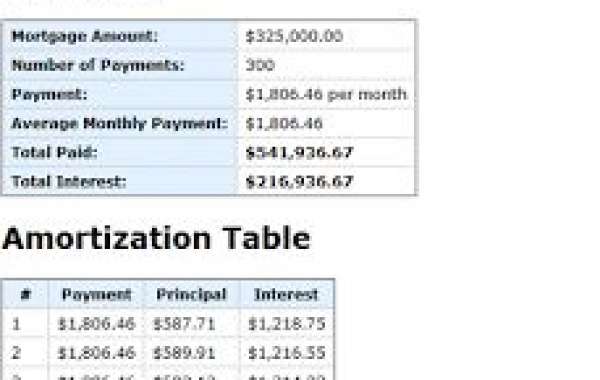

Understanding the way the regular cost is broken down is another critical advantage of utilizing a mortgage calculator. In the first decades of a loan, a larger part of the payment moves toward curiosity as opposed to principal. As time passes, however, the key part increases whilst the loan harmony decreases. A mortgage calculator usually offers an amortization schedule, which reveals that dysfunction over the life of the loan. This assists borrowers understand how significantly of these regular payment is certainly going toward lowering the loan harmony, and how much is essentially only paying the lender for the utilization of their money.

Certainly one of the main facets in determining mortgage funds may be the fascination rate. The rate at that your loan is financed straight influences how much a borrower can pay over the life of the loan. Small changes in curiosity prices may have a huge influence on monthly payments. As an example, a higher fascination rate increases the price of funding, indicating larger monthly obligations and more paid in interest over time. Alternatively, a lower charge reduces the regular cost and the entire cost of the Mortgage Calculator . Mortgage calculators let customers to experiment with various interest rates to observe how changes may affect their payments.

Mortgage calculators can also be helpful for evaluating different loan options. For instance, a borrower may choose to examine the regular cost on a 15-year loan versus a 30-year loan. The monthly cost for a 15-year mortgage may generally be larger as a result of shorter repayment time, but the total curiosity paid over the life span of the loan will soon be lower. By using a mortgage calculator, borrowers may reproduce various situations and decide which loan expression most useful suits their budget and long-term financial goals.

As well as supporting borrowers determine obligations, mortgage calculators also can function as an instrument for qualifying for a loan. Lenders often use certain standards, like debt-to-income percentage (DTI), to determine whether a borrower are able to afford a mortgage. A mortgage calculator can offer an estimate of the borrower's DTI by factoring inside their income and regular debt obligations. By pushing in their income and other debts, customers could see whether they match the conventional DTI demands for confirmed loan.

Yet another function that numerous mortgage calculators contain is the ability to estimate just how much a borrower are able based on the ideal regular payment. That is helpful for potential buyers who have a collection budget at heart but aren't positive how much home they are able to afford. By inputting a target monthly payment, the calculator may back-calculate the loan volume they could qualify for, factoring in the estimated interest rate and loan term. This provides customers a concept of the cost selection they should be considering when buying a home.

Ultimately, mortgage calculators aren't just for homebuyers—they're also ideal for homeowners who are contemplating refinancing their current mortgage. A refinance mortgage calculator will help establish the impact of refinancing on monthly obligations, curiosity prices, and the sum total loan term. It may also display whether refinancing will save profit the future or whether the expenses of refinancing outnumber the benefits. With the capacity to modify loan terms and interest charges, homeowners can evaluate whether refinancing is just a financially noise choice based on the recent